KLX London - Deep Dive Session

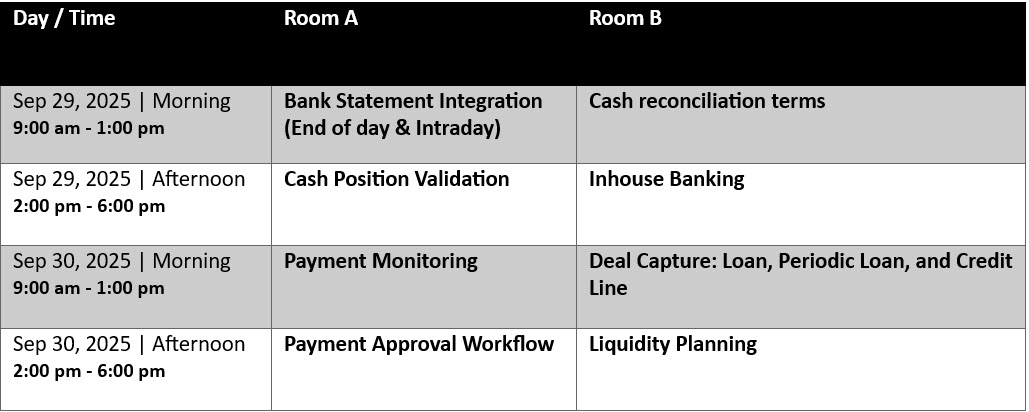

Instead of traditional step-by-step demonstrations, Kyriba Elevate has created interactive and collaborative sessions to keep you engaged. Our interactive sessions use real-life scenarios and hands-on exercises for practical skill mastery. Learn by doing, gaining confidence to apply skills independently in a supportive, collaborative environment Each half-day session features two training tracks running in parallel. Personalize your learning journey by selecting a morning and afternoon session.

Description

Monday, September 29th

Morning Session (Select only one)

Bank Statement Integration (End of day & Intraday)

This hands-on session teaches you to integrate and manage end-of-day and intraday bank statements in Kyriba. Gain confidence in troubleshooting and monitoring statement collection for critical cash visibility.

Cash Reconciliation Terms

Become an expert in creating cash reconciliation terms. Through a variety of real-life scenarios, you’ll learn how to configure the application for different types of reconciliations. This course is focused on hands-on practice, with minimal theory and plenty of practical exercises.

Afternoon Session (Select only one)

Cash Position Validation

Learn how to verify each day that your cash position balances match your bank’s records. If you find any discrepancies, you’ll learn how to resolve them. This fully immersive, hands-on session uses real examples to help you practice identifying and correcting variances.

Inhouse Banking

Master in-house banking in Kyriba. This immersive, hands-on session covers intercompany companies relationship to automatically track intercompany payments, manage balances, generate interest statements, and troubleshoot issues.

Tuesday, September 30th

Morning Session (Select only one)

Payment Monitoring

Master end-to-end payment monitoring: Learn to confirm payment creation, track status via the Payment Dashboard and Cockpit, address rejections, review acknowledgments, and resend failed transmissions using Bank Communication features. This is a collaborative, hands-on, scenario-driven session

Deal Capture: Loan, Periodic Loan, and Credit Line

Through practical exercises, learn to add and manage loans, periodic loans, and credit lines in Kyriba. This hands-on session covers the full deal lifecycle, including maturities, payments, forecasts, reports, and troubleshooting.

Afternoon Session (Select only one)

Payment Approval Workflow

Learn to configure and apply payment approval workflows in this hands-on, scenario-driven session. Gain confidence in setup, troubleshooting, and resolving common issues so you can confidently manage your payment approval workflow.

Liquidity Planning

Master forecast management with Kyriba's Liquidity Planning module. This immersive, hands-on session covers the full process: module configuration, manual forecast entry, version management, and reporting to boost your daily efficiency.